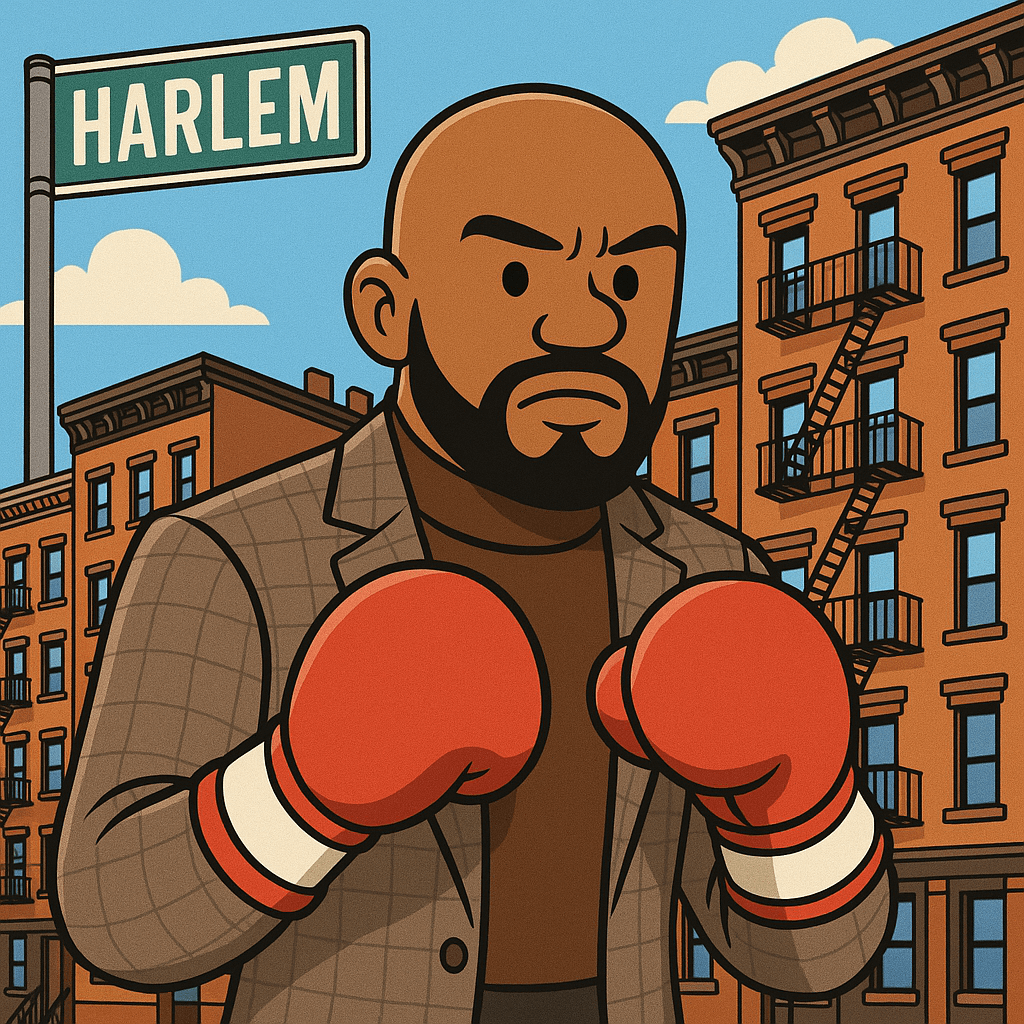

On a brisk October day just a couple of months ago, it was announced that Floyd Mayweather Jr. had inked a $402,000,000 deal to purchase 60 buildings with 1,000 rent-stabilized units from Josh Gottlieb’s Upper Manhattan portfolio. Countless professionals who have spent decades in the NYC commercial real estate space had a chuckle, assuming that Mayweather had just been handed his first loss in an otherwise illustrious career. Can you really blame them - $402,000 a unit for an asset class that seems to be losing value by the minute. The deal certainly appeared a tad rich.

It was later revealed that Mayweather had actually acquired a minority stake in Black Spruce Management’s 62-building portfolio, with an option to purchase the remaining portion outright. Nonetheless, the move still signals a massive bet on rent stabilization in NYC by the former welterweight champion.

One person who wasn’t laughing was Peter Hungerford. Around the same time as Mayweather’s acquisition, Hungerford purchased a 1,300-unit portfolio—consisting of 85% rent-stabilized units—for $180,000,000. While roughly 10% of the apartments were delivered vacant at closing (including both RS and FM units), which could hint at some value-add opportunities, to the average investor, these deals seem like a real head-scratcher.

That begs the question: Were Hungerford and Mayweather simply parking money into the CRE capital of the world, or did they know something you and I did not?

Fast-forward to March 29th, 2025 — Sen. Leroy Comrie introduces a pilot program that could allow owners of rent-stabilized units to receive the full voucher amount for a unit registered as “vacant” in 2025. If this passes, it could mark a significant milestone in the world of NYC rent stabilization. According to the New York City Housing and Vacancy Survey, there are currently 26,310 “vacant but unavailable for rent” rent-stabilized units across the city. Most of these units are in miserable, unlivable condition.

Considering that New York City is in the middle of a significant housing crisis—about 500,000 units short of what is needed—this new program could have major implications for both the fight for affordability,

as well as the fight to keep rent stabilized value “alive & breathing”.

What is this New "Pilot Program"?

If a property owner has a rent-stabilized unit registered as “vacant” on their DHCRs, they can receive the full voucher amount for that unit—an amount often in excess of the legal rent. The thesis is that this additional rental income should incentivize landlords to renovate these units, making it economically viable to bring them back onto the market. In order to qualify for the proposed program, the building must have been constructed before 1974. Additionally, the pilot would apply to local, state, and federal rental assistance programs, and it would expire in 2027.

While the city is attempting to appease tenant groups (who clearly can’t see past their NIMBY, “social” views), this program could also have major implications for the value of rent-stabilized assets. Since 2019 and the end of the once-glorious “sub-rehab play”, the value of rent-stabilized buildings has completely nosedived.

Nothing exemplifies this better than 312 East 106th Street—an 83% rent-stabilized building with 29 units. It traded on February 20th, 2025, for $285,110, representing an $8,539,890 loss compared to its last sale on December 26, 2016. Yes, the seller originally bought it for $8.825 million just nine years ago.

Fair to say, rent-stabilized assets are in desperate need of a boost in value if owners are going to be incentivized to renovate units. If NYC is so hellbent on keeping rent stabilization alive, perhaps this pilot program is a sliver of light at the end of a long, dark tunnel—even if it's just a minor step in a journey that feels like a marathon.